Marginal Efficiency of Investment is the topic every economist would love to read. The new one who is willing to know about the Marginal Efficiency of Investment, this article would help them to know about it.

Marginal Efficiency of Investment:

The few definitions of Marginal Efficiency of Investment are listed here which will help you to know about the various definitions and understand about it.

The simple definition of Marginal Efficiency of Investment is,” It is the estimated rate of returns from additional investment in the project.” – Prof.Keynes

It is also defined as,” Marginal efficiency of investment, in economics, expected rates of return on investment as additional units of investment are made under specified conditions and over a stated period of time.

It is also defined as, “The expected profit from an investment, as a per cent of the investment, measures the rate of return on the investment.

Economists call the expected rate of return on an addition to capital investment as the marginal efficiency of investment (MEI).”

A comparison of these rates with the going rate of interest may be used to indicate the profitability of the investment. The rate of return is computed as the rate at which the expected stream of future earnings from an investment project must be discounted to make their present value equal to the cost of the project.

It is said as if the number of Investment increases, then the rate of return is expected to decrease.

This term was first used by the British Economist John Maynard Keynes but with a slight difference and coined a different term Marginal Efficiency of Capital in arguing for the importance of profit expectations rather than interest rates as determinants of the level of investment.

Marginal Efficiency of Investment consists of 2 items:

- Supply price: the net cost of acquiring the assets for investment (cost of the machine is $1000)- How much I spend on it.

- Prospective Yield: estimated net returns from the investment. ($100) – how much I get from it.

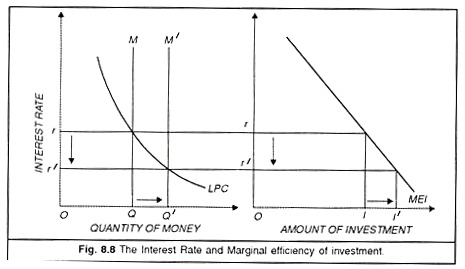

Once the MEI (or rate of return) on investment is estimated, the next step is to establish the cost of funds needed to finance the investment.

Then can one decide if the investment is worth undertaking? The cost of funds needed to finance investment is expressed as a percentage.

Thus, if a business firm borrows money for investment and agrees to pay an annual interest charge of, say, 10 per cent, then that is the firm’s cost of funds.

Alternatively, if the firm uses its own money, instead of borrowing, the interest return sacrificed by not lending the money in the financial markets (through the purchase of bonds or other securities) may be thought of as the company’s cost of funds.

This cost, of course, is the opportunity cost of funds. In any case, the MEI and the cost of funds are each quoted as percentages. Therefore, they can be easily compared. This makes it possible to determine the amount of investment which will take place.

This will help you to know about the Marginal Efficiency of Investment.

Marginal Efficiency of Capital:

The few definitions of Marginal Efficiency of Capital are listed here which will help you to know about the Marginal Efficiency of Capital and helps you to understand about it.

The marginal efficiency of capital (MEC) is that rate of discount which would equate the price of a fixed capital asset with its present discounted value of expected income.

The term “marginal efficiency of capital” was introduced by John Maynard Keynes in his General Theory, and defined as “The rate of discount which would make the present value of the series of annuities given by the returns expected from the capital asset during its life just equal its supply price”

The MEC needs to be higher than the rate of interest, r, for investment to take place. This is because the present value PV of future returns to capital needs to be higher than the cost of capital, Ck. These variables can be expressed as follows:

- {\displaystyle PV=\sum _{i=1}^{n}{\frac {R_{i}}{(1+r)^{i}}},} where n is the number of years during which the capital will be productive, and Ri is the net return in year i;

- {\displaystyle C_{k}=\sum _{i=1}^{n}{\frac {R_{i}}{(1+MEC)^{i}}},} where Ck is the upfront capital outlays; this equation defines the MEC

The difference between the Marginal Efficiency of Investment and Marginal Efficiency of Investment is that Keynes used the term ‘marginal efficiency of capital’ to refer to the unique rate of discount which would make the present value of the expected net returns from a capital asset just equal to its supply price when there is no rise in the supply price of the asset.

The term originates with Keynes and is sometimes known incorrectly as the internal rate of return.

Generally, the marginal efficiency of capital or MEC refers to the expected rate of profit or the rate of return from the investment over its cost. Marginal efficiency of a given capital asset is the highest return that can be yielded from the additional unit of that capital asset.

This latter concept is distinct in that it takes specific account of the fact that the supply price of capital assets will rise in the short run as all firms simultaneously seek to increase the size of their capital stock.

These are the definitions of Marginal Efficiency of Capital and also the difference between the Marginal Efficiency of Investment (MEI) and Marginal Efficiency of capital (MEC).

Factors affecting the Marginal Efficiency of Investment:

The factors that are affecting the Marginal Efficiency of Investment are listed here:

- Interest rates (the cost of borrowing)

- Economic growth (changes in demand)

- Confidence/expectations

- Technological developments (productivity of capital)

- Availability of finance from banks.

- Others (depreciation, wage costs, inflation, government policy)

These are the factors that are affecting the Marginal Efficiency of Investment. This will help you to know about the factors.

The one who is studying about Marginal Efficiency of Investment (MEI) and also helps to know about the Marginal Efficiency of Capital (MEC) this will help to know and study about them.