Third-party payroll is good or bad for employee career. Everyone has this kinda questions which they are eager to know about. In this article, you will get to know about the Third-Party payroll and whether it is good or bad for the employee career.

Literally, the Third-party payroll involves when a third party or the company enters or processes the payroll on the behalf of another company, who provides all kinda payroll support to their own clients.

There are many companies that we can work who can produce their own payroll software. They may also have clients who have licensed software.

What is meant by Third-party payroll service?:

The third-party payroll is explained as the outsourcing payroll responsibilities of an employer and also the part of the payroll, and tax-related duties to the third-party payroll services providers.

An employer will enter into the contract or the agreement with a third-party so that they can agree to fulfil and maintain the duties of the employees in third-party payroll services. This is meant by the third-party payroll service. In the upcoming topics, you get to know about the third-party payroll services in detail.

What is meant by Contractual Staffing?:

Contractual staffing refers to the recruitment of the employees for the short-term employment contracts which is opposed to full-time permanent workers. Contractual staffing will increase and also become popular because of the benefits for the workers and employers. It also allows personal methods that allow employers flexibility. This is meant by contractual staffing.

Benefits of the Third-party payroll:

It is said that In India, contract staffing is not an old method. It is the kinda new way of employing which had found focus and also success and popularity among the businesses. Many services are handled by contract staffing in India like Onboarding, Compliance Management, 3rd party payroll services, issuing offer letters to the temporary employees, termination formalities.

Everyone at the moment doubts whether they charge or not..?

To be sure, they do charge a fee. But also hiring the third-party contract staffing agency services gets a lot of benefits in returns. Such benefits are mentioned below. They are:

- Time Saved

- Expenses Reduced

- Experts at Work

- Peace of Mind.

These are the few benefits that help.

1. Time Saved:

The prospecting and recruiting the right talent is kind of time-consuming and also a long process. The outsourcing in the third-party payroll management it saves time. This will help the new recruiters and the one who is in search of a job.

2. Expenses Reduced:

The contract staffing has immediate data provisions and the infrastructure that is framed by the payroll and also the acquiescence experts which enables to hire the new recruiters to hire at the lower cost.

3. Experts at Work:

The contractual staffing partners will specialise by having a team of experts who handles the recruitment, payroll and compliance and also the employee management. Also, these firms guarantee that observe in constant time that changes the regulations and also the government norms.

4. Peace of mind:

We can have peace of mind, by choosing the third-party payroll services, you can feel free by paying salaries, managing compliances, payroll taxes, maintaining payroll software and also generating the reports for house use. Also freeing the time and resources will accelerate business growth.

These are the four benefits that will help you to understand about it.

Disadvantages of third-party payroll service:

The disadvantages of the third-party payroll service are:

- The cost of recruiting. Working with third-party recruiters requires a fee for their services

- Lack of control. For many HR or hiring managers, it is difficult to give up control over the hiring process

- Indirect candidate access

- Communication issues.

These are the disadvantages of third-party payroll service.

Business Idea for Third-party payroll services:

The few of the ideas for the business ideal for the third-party payroll services are mentioned below:

1. IT companies that include Banking, Hospitality and Finance etc.

2. Non-IT organizations that also includes retail, Construction, and pharma etc.

3. BPO sector which includes Voice, Non-Voice, Customer support etc.

It is also said that the payroll is time-consuming for the non-core business function. And also by the non-core, it not only serves as a centre for the profit, and also the essential. The business has long outsourced it to the third-party payroll services. These are the business idea for the third-party payroll service.

The reasons for considering the usage of temporary employee services:

Here are the reasons for considering the usage of temporary employee services:

- You can identify a candidate that you would like to recruit for a project and also to avoid them for the third-party recruiting fees.

- If you want, you may have a trial period before making a comprehensive offer to the employees.

- You also have a component of the workforce that will perform more effectively and also a flexible staffing program.

- Also, this temporary period will allow you to evaluate the employees with suitability and also contributions.

- While the employees are payrolled, they may have the eligibility for the excellent benefits and also have the weekly pay via direct deposit.

These are the reasons for considering the usage of the temporary employment service which will help you to know about the employment service.

Third-party payroll is good or bad?

Third-party payroll is good or bad for the employee career?. That is a good question and the answer depends on the third-party employment company in which you are employed. These days it doesn’t matter whether you are employed in Third-party payroll service or not. They also count only in your skills and experience. Here are the reasons that the third-party payroll is good or bad and also you get to know in detail about it.

Third-party employment service is good for the freshers who just came from the universities and colleges. It is also difficult to get normal employment with no experience. When it comes to the candidate they don’t need to get employed through a third-party employment service.

Even though the third-party payroll has many benefits and advantages, there are few drawbacks with the services. There are many risks involved in third-party payroll services which is the biggest job security. Also, the company can ask you to leave when they want. There is an unfair treatment with the employees not working on direct payroll.

In many cases, the third-party payroll services will have their separate corporate offices which are far from the organisations where the employees are working.

In every case, the employees will suffer to get the payslip and also to get the provident fund claims etc. many employees have struggled a lot.

Also, the Job security in third-party payroll is only limited and the limited companies hire the people as per the project requirement employer liability is very much limited and also the offer letter is very much predefined and also can be terminated within the short span of the time without any compensation.

Working with a third-party payroll provider allows the employers, managers and the business owners to focus on the essential and also the non-administrative functions of their business. The third-party service will also limit the chance of any costly payroll errors to also help the employers to avoid the fines.

Gusto as the best payroll service provider for sole proprietors or the corporations. OnPay is the best payroll service for a very small business. ADP as the most popular payroll company, and Paychex as the best payroll for the larger business.

On the revenue statement, payroll taxes are part of labour costs. They include employee wages, employer payments for health insurance or similar benefits, payroll taxes paid by the employer, bonuses, commissions and similar expenses.

The costs are connected with any payroll. There’s usually an essence fee from $10 to $85 per month. You might also have to pay an additional fee for each worker on the account, anywhere from $5 to $15 per person per month.

The services offered are tailored to meet business’ requirements. Onboarding, compliance management, third party payroll services, issuing offer letters to substitute employees, and even formalities are handled by contract staffing companies in India.

The reasons to switch to third party payroll service:

It is said that payroll processing is really a hard task that is to accomplish and also tracking the payroll of the employee with the tedious work. Many companies really choose to outsource the payroll activities because they see it has cost-effective and also time-saving. Many different organizations have many different budgets and also they require several other solutions for different challenges. The three reasons to switch to the third-party payroll service are:

- Salary processing

- Tax Calculations

- Cent per cent compliance.

1. Salary Processing:

The payroll specialists have expertise in managing the payroll of the contract of the employees. The salary calculations will take a lot of time and energy of any organization resource and the reliability on a third-party payroll service and also providers take the responsibilities. Third-party payroll services which provide and also perform the routine task like tracing the attendance, calculating the overtime work etc.

2. Tax Calculations:

The dynamic capabilities of handling the complex tax responsibilities super efficiently. Also to the salaries, and the paperwork required by the organization.

3. Cent per cent compliance:

As a third-party payroll service provider, make sure that the payroll processing is done better by the accuracy and also ensure that your organization doesn’t need to pay any fines. The experts will help you to stay compliant with that of regulations and also compliance.

These are the reasons to switch to the third-party payroll service.

The important things to consider before utilize the third-party payroll service:

1. How Much Will it Cost?:

The first thing you have to simplify with your payroll agency is that their pricing and their service is you can help at the particular cost. First of all, Make sure to explore that there are hidden costs that are also available. You need to compute what your payroll management budget is and you have to fulfil your needs for the price you want.

2. What is the Process behind Your Payroll Management?

The third-party payroll companies are that you are intended to engage that should have a process in place. Also at the same time, they should be flexible enough to modify your company’s changing requirements. Also, there should be transparency with respect to all the strategies.

Also, they should be willing to work on the schedule without having to comply. The most significant is that the business owner is to dig deep and also to find out how accurate and consistent. The companies should be able to demonstrate confidence. These are the process behind the payroll management.

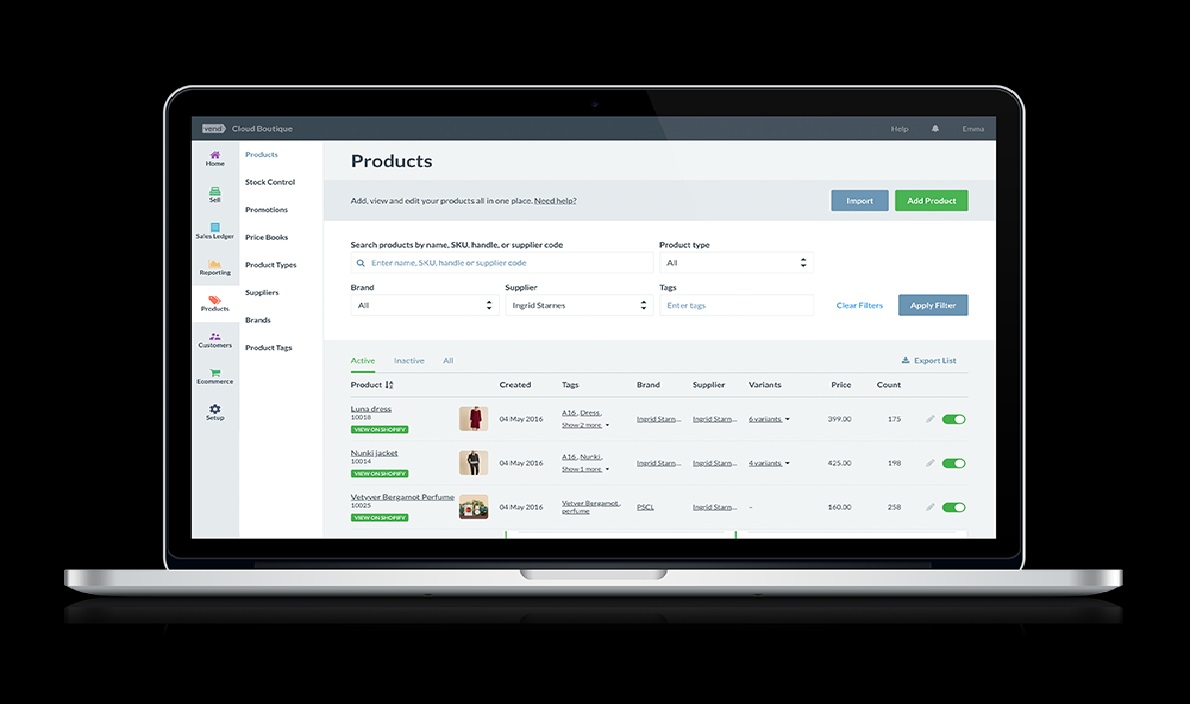

3. What is the Extent of Automation for Third-Party Service?

It is important to gain understanding and the type of technology, that your third party companies use and also the features that has and what it can achieve. Also, the key features are that the functionality and scalability of the company. The third-party companies with advanced user-friendly systems are cloud-based.

Payroll administrator needed to demonstrate the following:

The payroll administrator will be needed the following to demonstrate. They are mentioned below:

- Excellent numeracy and literacy skills.

- Good timekeeping and an ability to meet strict deadlines.

- Organised, logical and methodical approach.

- Ability to remain calm under pressure.

- Flexibility. …

- A keen eye for detail and accuracy.

The payroll administrator needed to demonstrate is mentioned above.

Third-party payroll jobs:

The Top 5 third-party payroll jobs are mentioned below

1. Marketing Executive-MBA:

Company: Synigence Global Services limited

Place: Thane

Contract Period: 1-2 years

Salary: 120000-150000 INR

2. India payroll:

Company: Top source Infotech Solutions private limited

Place: Pune

Contract period: 3-12 years

Salary: Not particularised

3. Android developers for video call and Audio call

Company: Ai-logic neural private limited

Place: Hyderabad/Secunderabad

Contract period: 5-10 years

Salary: Not particularised

4. Software developer

Company: Pear Visa Immigration services limited

Place: Canada/Australia

Contract period: 2-10 years

Salary: 7550000-9440000 INR

5. IOS developer:

Company: XinThe Technologies private limited

Place: Vishakapatnam

Contract Period: 3-8 years

Salary: Not particularised

These are the few third-party payroll jobs that are available right now.